Easy Merchants Loan : Bharatpe Loan Process

Friends, as we all know, in today’s time it is not so easy for anyone to take a loan and for the one who is given a loan, many types of documents are demanded for that. in Today’s topic we are going to know about a leading fintech company of India . The most special thing about this company is that – it gives loans to even the smallest businessmen/shopkeepers on the basis of Very easy documents.

In this blog post, we will know step by step what is Bharatpe Loan Process and how we can easily take loan from ₹ 10,000 to ₹ 10,00,000 to expand our Work or Business.

Eligibility Check for Loan :

Even before starting the loan application, it is very important that we already know whether we are eligible for the loan or not. Bharatpe provides loans only to shopkeepers, retailers and merchants, a basic condition for taking this loan is that you should have a shop and one more very important thing is – Bharatpe’s QR Code should be installed on which you are taking your business payment Via PhonePe / Paytm / GooglePay .

Download BharatPe Application :

BharatPe provides a very beautiful dashboard application for its customers and merchants . This application is available for both Android users and Apple users. You can download it by visiting the official website of BharatPe Or you can also install it directly from Google Play Store or Apple App Store.

Official Website : https://bharatpe.com/

Application Name : Bharatpe For Merchant

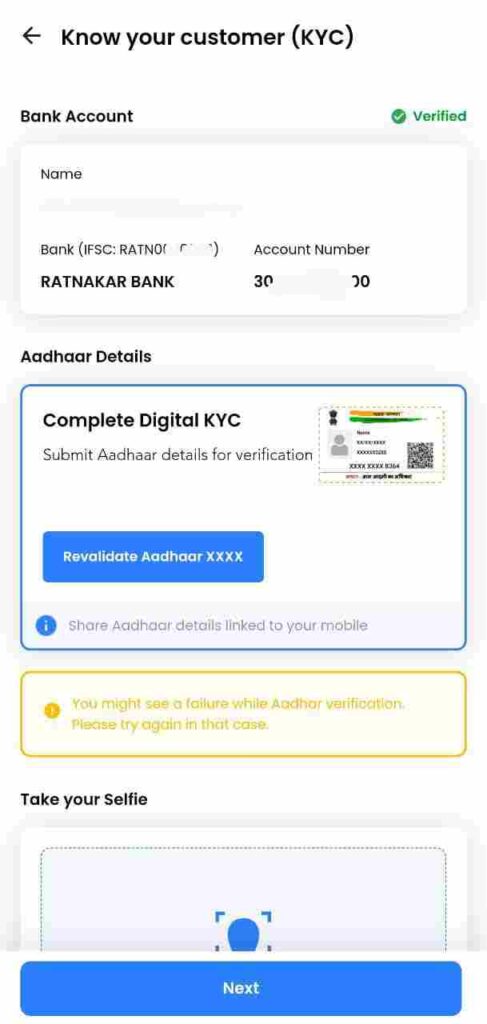

Onboarding And KYC :

Once you have installed Bharatpe application then you have to register in Bharatpe merchant App through your mobile number – First of all you have to enter your mobile number. After entering the mobile number, an OTP comes on your number, If your number gets verified Then you can continue your KYC process further. To complete the KYC process, you must have your original –

- PAN card

- Aadhaar card

- bank details

One more thing, it is very important to have a mobile number linked with your Aadhaar card.

TIPS- Try to Onboard Yourself through BharatPe Field Sales Executive, They Provides you Free QR Code , Free QR Standy and They Can Guide you About the Complete Application.

I will Give you 10 More Tips to approve Your Loan , keep Reading this Articles .

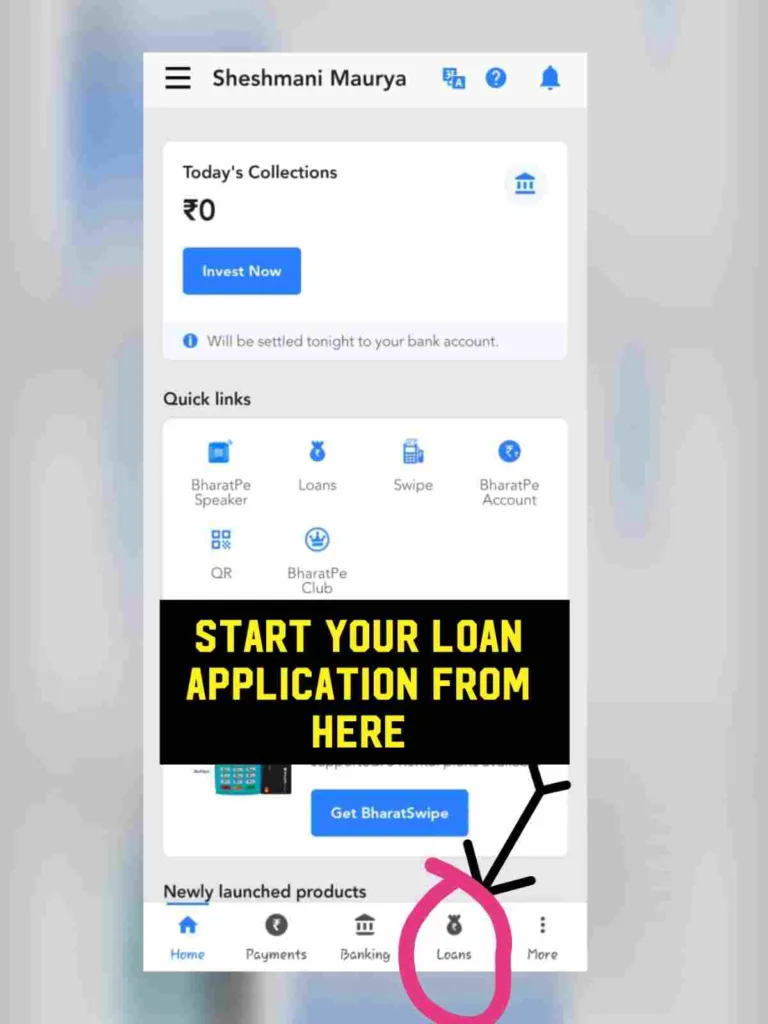

Start Your Loan Application :

If you have completed your KYC, then now you have to come to the homepage of Bharatpe Merchant App and here below you will see the loan menu – by clicking on the loan menu, you have to choose your desired loan amount and choose loan tenure. You may be asked to upload some KYC documents again, you may upload the KYC documents for the loan again and apply for the loan. In most of the cases, here you get to know the exact whether you are eligible for BharatPe Loan or not. If you are eligible, then the process will go ahead, if you are not eligible then you will be shown a dashboard of not eligible.

Make Sure Your All Documents Are Correct.

If you are not eligible, do not worry, you can still be eligible, below you will find some such tips and tricks, by which you will be able to make yourself eligible for Bharatpe Loan as soon as possible.

Required Documents For Loan Approval :

To get your loan approved as soon as possible, try to upload whatever is the mandatory document.

you have to upload only some basic documents which everyone has-

- Aadhaar Car

- pan card

- Selfies

( Complete Face Should Clearly Visible)

- GST (Not Mandatory)

- 2- Shop Photos ( One Front and One Stock Photo )

Friends, these are the documents that you will upload at the time of loan application.

Here it is necessary to link your mobile number with Aadhaar card because the photo of Aadhaar card is not uploaded, you have to do Aadhaar card digital KYC by entering your Aadhaar number and Verify By Aadhar OTP.

Here you do not need any kind of bank statement, any business proof, invoice purchase order OR bills , you do not have to Upload these documents.

Wait For Loan Disbursement :

Once you have applied for the loan with all the required documents. then you have to wait

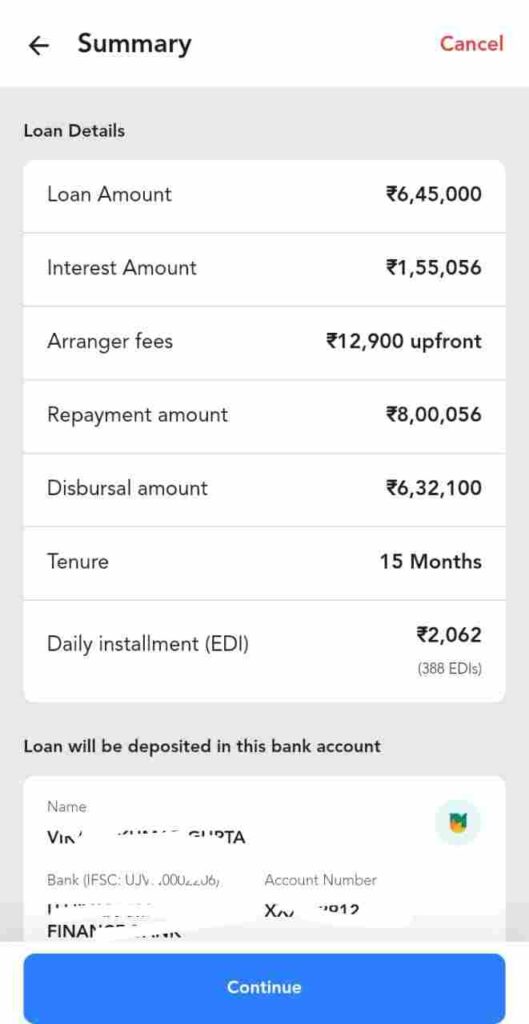

Further processing takes 7 to 10 days. But in most of the cases the loan is disbursed within 24 to 48 hours, still you have to take a maximum time of 7 days. After the loan offer is applied, the status of the loan will be shown in front of you, to understand it better, I have put a screen shot of an applied loan below, see it –

Here in Screen shot You Can See the –

- Interest Rate

- EDI ( Daily Repayment Amount )

- Tenure

- Application Status

EDI goes only 6 days a week EDI doesn’t go on Sundays.

Pay Your Loan (EDI) :

In normal loans, we pay our EMIs, but friends, here you have to pay EDI (Easy Daily Installments) after getting the loan. This is because this loan is specially designed for small shopkeeper , And The shopkeeper earn daily, That’s why the company gives them the option of Pay their loans every day. This is a very easy processor for the shopkeeper.

Loan is available only to those who have Bharatpe QR-Code and they accept daily payment on it. Out of these payments, your daily amount is deducted and the remaining amount is transferred to your bank account every day.

Remember your EDI is not directly deducted from your bank account, it will be deducted from the payment taken in your Bharat App only. But in most of the cases it has been seen that when you do not take payment on your BharatPe QR for more than seven days, then the company deducts the Due amount directly from your bank account through ECS. In this Case you May Have to pay the Bank ECS Charges.

Important- One More Very Important thing About Repayment, EDI goes only 6 days a week EDI doesn’t go on Sundays.

Loan Dashboard :

Best Loan Dashboard, Inside BharatPe Merchant App, you get to see a very easy loan dashboard, from where you can get all the information related to this loan, such as your loan details, including the outstanding balance, upcoming EMI due dates, and repayment history.

In this loan, you get to see the option of pre close Loan where you can pre closed your loan whenever you want. There is no extra charge for Pre closing your Loan , nor do you have to pay the remaining interest. You have to pay interest till the day you Keep loan Amount .

Conclusion

After looking at all the points, it can be said that this loan option is a great option for many shopkeeper brothers, where they can easily get a loan of up to ₹ 10,00,000 without having to submit a lot of documents. And they can pay it from their daily earnings.

Remember, when we apply for the loan, you are asked for two photos of your shop, which you upload and take the loan from here.

There are some very important tips and tricks for you, if you follow it properly, then you can definitely get a loan from BharatPE Merchant App-

- Do not apply loan immediately after installing the application, first you receive some transactions automatically, then you apply for the loan.

- While applying for the loan, fill the business name carefully. If there is a board at your shop, then try to type your business name only as it is written on the board. With this, your shop verification will be done quickly and your loan will also be approved.

- When you are asked to upload the photo of the shop while applying for the loan. So you come out from your Shop and click the photo. In which the view of your entire shop and its surroundings should come, click the second photo in such a way – The goods inside your shop are visible properly, and if you have Bharatpe’s QR-code, then that also comes in the photo.

- After applying for the loan, take maximum number of transactions per your Bharatpe QR-Code. If you take more and more transactions, your loan approval will be faster.

- After getting the loan, pay your installments on time. With this, the next loan amount you will get will be increased and will be available at a lower interest rate.

Helpful Screenshots :

FAQs

Yes You Can , In most cases, this loan is only for small shopkeepers, retailers, and merchants, but I have seen that if you are using Bharatpe App regularly for more than six months, then you get a loan offer.

For Appling loan with BharatPe, follow these steps:-

- Download the BharatPe Application from Your App Store.

- Complete Your Onboarding with Correct Information

- Submit Your KYC documents, Like – PAN card, Aadhaar card, and bank account detail.

- Select the Required loan amount and Loan tenure.

- Complete the Application Process Step by Step As mentioned Above

- After Apply wait for your loan approval and disbursement.

Only Some Basic Documents

- PAN card

- Aadhaar card

- Bank Detail

- GST Number (Not Compulsory)

- Your Shop Photo And Selfie 🤳

After submitting your loan application and documents, in most cases the loan is disbursed within 24 to 48 hours, however, you have to take a maximum of 7 days

Yes, Definitely You Can choose the loan amounts from ₹10,000 to Maximum Your Eligibility Loan Amount and repayment tenures ranging from 3 to 15 months. You can select the loan amount and repayment tenure According to your Daily Paying Capital .

Here you have to pay EDI (Easy Daily Installments) after getting the loan, this is because this loan is specially designed for small shopkeeper brothers And They Earn everyday, so the company has given them the option of Pay there Loan on daily basis .

Yes, inside the Bharatpe Merchant App, you get to see a very easy loan dashboard, from where you can get all the information related to this loan, such as your loan details, including the outstanding balance, upcoming EMI due dates, and repayment history.

NO hidden Fees or Additional charges

Around 2% Loan Processing Fee the Deduct from Your Disbursed Loan Amount. But if You Are a Bhartpe Club Member then Upto 1500 You can Take Back as a Cash Back After Completed Your Loan EDI on Time .

Bharatpe Customer Care Number – 8882555444

Official Website – www.bharatpe.com

- Delhi (Head Office)- BharatPe, Building No. 8 Tower C, 7th Floor, DLF Cybercity, Gurgaon-122002 Haryan

- Mumbai- 4B-20, 4th Floor Pheonix Paragon Plaza, Pheonix Market City L.B.S. Marg, Kurla (West) Mumbai – 400070

- Pune – Office No 108, City Point Building, Dhole Patil Road Pune – 411001′

- Bangalore – 579/B, 2nd Floor, RT Square, Sector 6, HSR Layout Next to Bank of India, Bangalore – 560102.

- Hyderabad- 56th Floor, Dwaraka Center Plot no. 57, Hitech City Rd, VIP Hills, Jaihind Enclave, Madhapur, Hyderabad, Telangana 500081

These All information Are Also Available on his Official website I suggest for visit to his Address make sure once by customer Care.

1st of All thanking you soo much For Reading this article

Plz show your love with Sharing this Article to others . And comments your Suggestions.

How useful was this post?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

( Complete Face Should Clearly Visible)

( Complete Face Should Clearly Visible)

Amazing explained…

Woww

Thank you so much 💛🧡❤❤❤

Bro congratulations for AdSense Approval ❤❤❤❤✌✌👌

Bro i tried this application it was showing loan upto 10 Lakh. But when I applied the it’s showing You are not eligible for loan.

Now what to do please tell me bro i need instant loan.

NO issue bro

it will take some time . you need to do transactions on this application.

i would like to suggest to contact Bharatpe Customer Care Number – 8882555444

Very nice 👌

Thanks so much for reading my blog. I’m so grateful for your support. It means a lot to me. I hope you keep coming back for more ❤

Gd going shesh

Thank you so much 💛🧡❤❤❤

nice initiative shesh !!

❤ ❤✨✨✨❤❤

nice initiative shesh !!

keep it up

❤ This Complete Article, I would like to dedicate to you.

thank you so much for Your Appreciation And Blessings.

👏👏👏👏

Hey dude it’s amazing Article…

Just read completely

It was very helpful.

Thanks so much for reading my blog. I’m so grateful for your support. It means a lot to me. I hope you keep coming back for more!